Why would I need someone external to work on my DDQ and PPM?

The process of writing the DDQ and the PPM is time consuming and requires extensive access to information from multiple business divisions at a time when senior team members are overstretched. Even if you have internal resource, allocating it and ensuring senior and mid-level prioritisation can be challenging without a strong project lead or external involvement.

Whether you have a full suite of fantastic documents or you’ve never created one before, having external advice to challenge your thought process, strengthen your messages and hold you to industry best practice will improve your investor relations materials. Having documents that are impactful, clear and detailed is the best way to ensure a successful fundraise.

How much support do I need? How does it work?

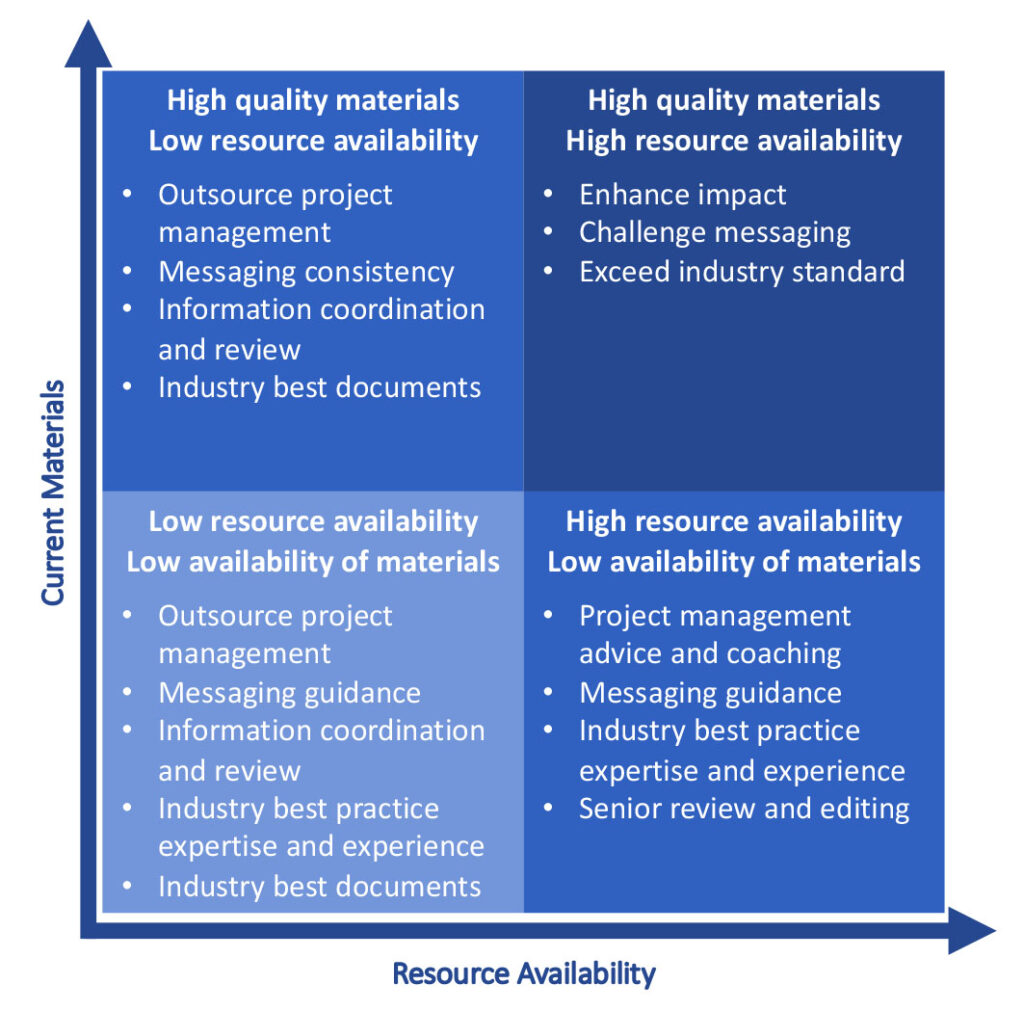

You’ll need to consider both resource availability and efficiency. Try to get a realistic idea of how much capacity you have, to drive the project as well as create the content. It’s also important to consider your internal gravitas; an effective project lead will need to motivate busy senior individuals.

An external adviser should begin with a review of your current materials to guide you assess their quality versus industry best practice. They will offer an objective, honest and external perspective. At that point they should be able to set out a clear course of action and timeline for you.

I’m paying my lawyers a lot of money, isn’t the PPM a document they should take care of?

No, this is a critical marketing document. It’s true that the PPM is a disclosure document, the lawyers will provide the bulk of the pages, but having seen and liked your pitch this is your chance to give the investor details that strengthen your message and set out exactly what they will receive in return for their money. They want to know exactly what kind of assets, how they will be chosen, how they will be monitored and what terms are attached to them etc.

This is a legal document that will bind you to the terms of investment, it’s really important to add enough detail to avoid potential confusion, but to keep enough flexibility to effectively manage the fund. From an investor’s point of view, the purpose is to obtain information about the fund and the company, both good and bad, to allow them to make an informed decision. From your perspective, the purpose is to provide necessary disclosures about the manager and fund to protect against claims of misstatements or omissions.

Isn’t the DDQ just a due diligence document that no one reads?

The DDQ is above all a marketing document, it is an opportunity to reiterate and expand on your key messages. It contains an investor’s most frequently asked questions so may appear to be a Q&A exercise, but it should convey a clear and strategic story that deepens your message.

Most investors carry out extensive diligence to be sure that you have the structure and capabilities to deliver before investing; they definitely read it. If it’s a clear and comprehensive DDQ it will make the process faster and easier for everyone.

If your standard DDQ doesn’t cover all of their questions, investors will follow up with any additional questions or ask you to fill out their own questionnaire. It’s well worth spending a little extra on a well written DDQ in the early days to avoid the headache of completing multiple bespoke questionnaires.

Why does it matter so much?

It matters because these documents are the first and last view of your business. They give substance to your pitch and if written well, will lock your message into the reader’s memory. It’s a chance to get LPs excited with the detail, but it will also bind you to your promises. These documents are marketing materials that need to be clear and consistent to enhance your story and differentiate you from the competition.