Despite ongoing uncertainty, insurance companies are more optimistic about the global investment landscape than at any time since 2016 and are not planning on a de-risking asset re-allocation in 2023.

Their expectations of credit quality deterioration and recession in the US, seem to not have deterred insurers from retaining a risk-on attitude, and even increasing asset allocations to certain pockets of alternative assets with a view to tactically leverage their macro and fundamental views.

Insurers’ asset allocation plans and expectations for the year ahead, as revealed in Goldman Sachs’ 2023 Global Insurance Investment Survey, support our conviction that investment funds in alternative space still have enormous opportunity to grow their AUM if they position themselves correctly.

The Goldman Sachs survey, which incorporates the views of 343 Insurance company CIOs and CFOs representing over $13 trillion in global balance sheet assets, gives valuable insights into what insurers are prioritising in their portfolio decisions.

Increasing yields boosting optimism

As expected, insurers now view increasing yield opportunities as being the most important factor driving asset allocation decisions (68%). This far exceeds the proportion of respondents planning to decrease risk because of concerns about equity or credit losses (25%).

While the uplift in fixed income yields is proving tempting to insurance investors, they are expected to continue to construct positions across broader private asset classes as they seek to diversify portfolios both in terms of risk/return and cash flow profiles.

Private debt expected to be the winner but private equity remains top performer

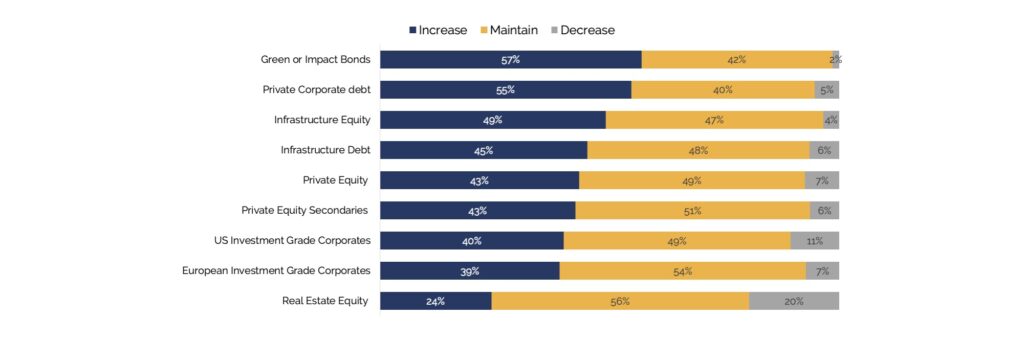

Although private debt is the top asset class to which insurers plan to increase allocation over the next 12 months, private equity remains highly attractive. In fact, insurers expect private equity and private equity secondaries to generate the highest total returns in 2023.

ESG factors increasingly critical to investment decisions

ESG and impact investing continue to influence portfolio construction, with 90% of respondents considering these factors across their investment decisions. Current and anticipated regulations, board directives and risk mitigation are cited as the primary motivations for considering ESG implementation within portfolios. Reflecting this emphasis on ESG and sustainability, insurers across all regions expect to increase allocations to green or impact bonds.

Winning formula to catch LPs’ interest

LPs continue to prioritise a combination of fundamental asset quality and upside potential in their portfolio allocation decisions. While LPs maintain a healthy risk appetite, biased towards private assets, rising interest rates and reduced monetary policy support mean LPs are searching for evidence of how a fund’s strategy offers portfolio diversification benefits and how well it is positioned to navigate a “new normal”.

Insurers decisions towards asset classes allocations in the next 12 months*: (Source: Goldman Sachs’ 2023 Global Insurance Investment Survey)

Note (*): excluding insurers who “do not invest”.